Stablecoin laws: Only six countries had legislation in place in 2023

The industry of stablecoins — or cryptocurrencies like Tether (USDT) and USDC (USDC) — has seen impressive growth over the past year, with the market value hitting new all-time highs in 2023. Despite this rapid expansion, only a few countries have started regulating the market, according to a new report.

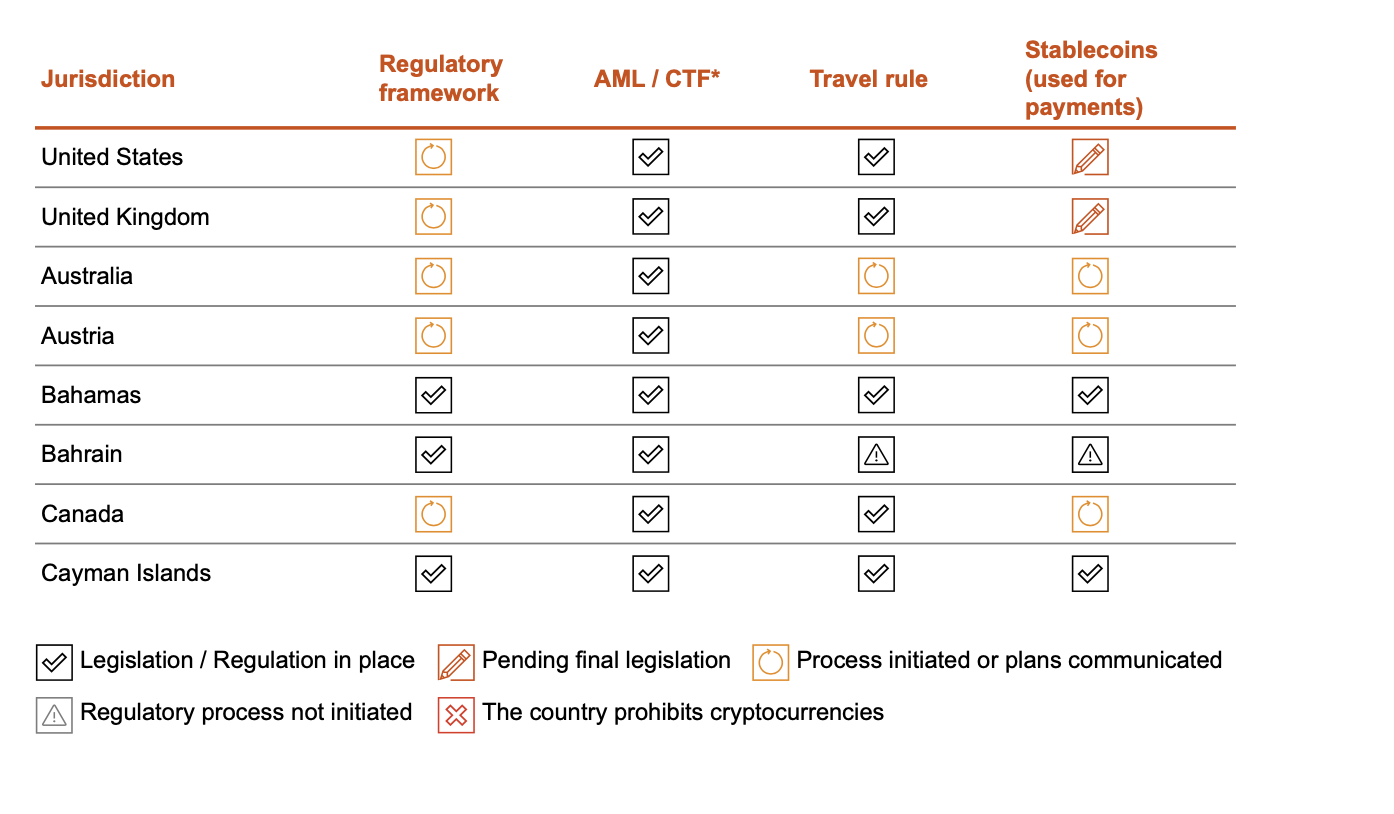

Only six countries had stablecoin legislation or regulation in place in 2023, according to the PwC Global Crypto Regulation Report 2023 published on Dec. 19. These countries are The Bahamas, The Cayman Islands, Gibraltar, Japan, Mauritius and Switzerland, according to the PwC’s analysis and regulatory assessment.

The countries that enacted stablecoin laws have also enforced all the other reviewed regulations, including a crypto regulatory framework, Anti-Money Laundering (AML) rules and the Financial Action Task Force’s Travel Rule, the report notes.

In its new crypto regulation report, the professional services firm assessed the status of crypto regulations in 35 countries, including the United States and the United Kingdom. According to PwC’s analysis, countries like the United States and the United Kingdom have yet to finalize legislation for stablecoins and develop a regulatory framework for cryptocurrencies.

According to the report, 40% of the analyzed countries, or as many as 14 jurisdictions, have not initiated any stablecoin regulations at all. Such countries include Denmark, Estonia, France, Germany, Taiwan and Turkey. 25% of the reviewed jurisdictions, including Hong Kong and Italy, have the stablecoin regulation process initiated or plans communicated, while only about 9% of countries, including the United Arab Emirates, are finalizing stablecoin laws.

PwC’s report also notes three countries that have prohibited the use of cryptocurrencies, including mainland China, Qatar and Saudi Arabia.

Related: Stablecoins ‘not a safe store of value’ — BIS

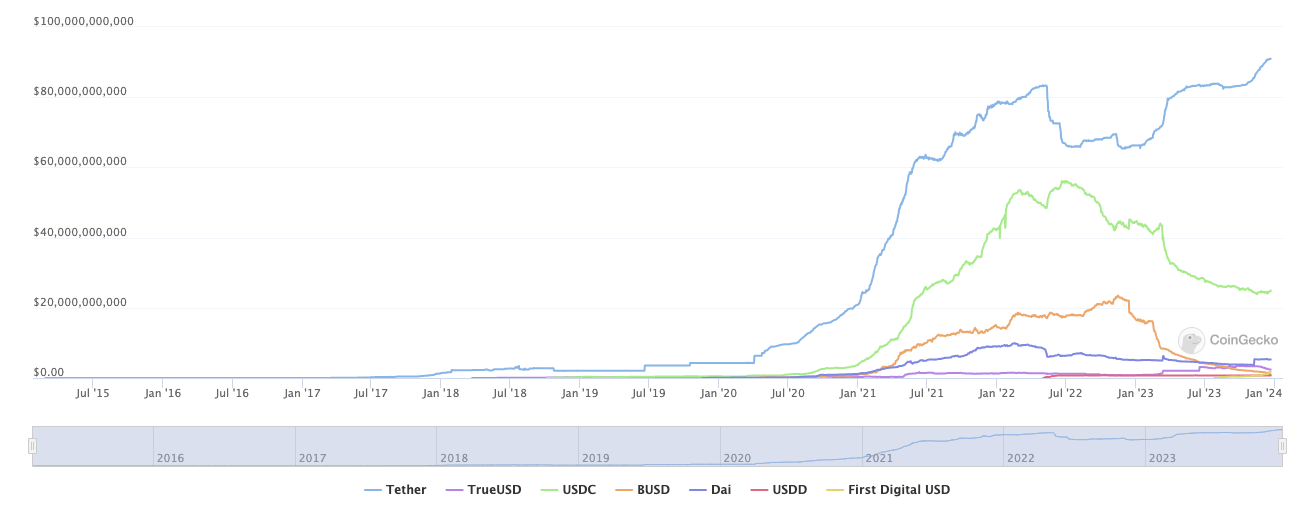

Stablecoins are an integral part of the cryptocurrency ecosystem, with the Tether stablecoin being the most traded asset on a daily basis. According to data from CoinGecko, Tether’s daily trading volumes are 23% higher than those of Bitcoin (BTC), amounting to $34 billion.

The stablecoin market has increased in 2023, adding billions in value due to the sharp growth of Tether and other stablecoins. Tether’s market capitalization broke above $90 billion for the first time in mid-December 2023, racking up 36% growth since January.

According to data from CoinGecko, the total stablecoin market capitalization has been hitting new historical highs this year, reaching a new record of $131 billion.

According to some analysts, stablecoins will continue to grow further in the coming years. Bitwise’s Ryan Rasmussen believes that stablecoins will settle more money in 2024 than the global payment giant Visa.

Magazine: DeFi’s billion-dollar secret: The insiders responsible for hacks

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.

Title:Stablecoin laws: Only six countries had legislation in place in 2023

Url:https://www.investsfocus.com